NC DoR NC-5X 2013-2026 free printable template

Show details

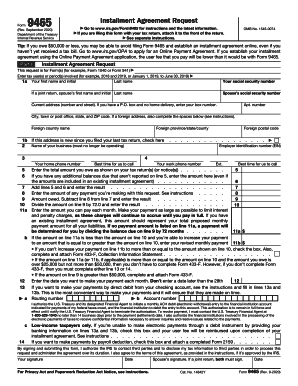

Use Form NC-5X to amend a previously filed Withholding Return, Form NC-5. This document includes instructions on filling out the form, including reporting corrected tax withheld, overpayment, and

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign nc5x form

Edit your nc5 online form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nc 5x fill in form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nc 5 online online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ncdor nc 5 form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NC DoR NC-5X Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out nc 5 form

How to fill out NC DoR NC-5X

01

Obtain the NC DoR NC-5X form from the North Carolina Department of Revenue website.

02

Carefully read the instructions provided with the form to understand its purpose.

03

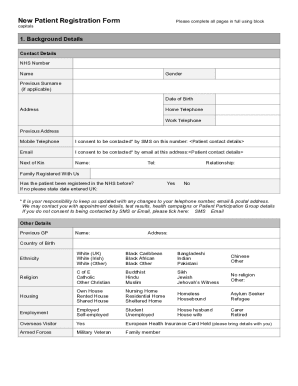

Fill out your personal identification information at the top of the form, including your name, address, and Social Security number.

04

Specify the tax period for which you are filing in the designated section.

05

Complete all relevant sections regarding your income, deductions, and credits as applicable.

06

Review your entries for accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the completed form either electronically or via mail to the North Carolina Department of Revenue.

Who needs NC DoR NC-5X?

01

Individuals or businesses that need to report adjustments to their previously filed North Carolina tax returns.

02

Taxpayers who have received notices from the NC Department of Revenue regarding amendments.

03

Anyone seeking to correct errors or change information on prior tax filings.

Fill

nc 5 form

: Try Risk Free

People Also Ask about this document includes instructions on filling out the blackout data for discretion add comments and more

What is form d400v?

Individual Income Tax - Form D-400V. The Refund Process. Pay a Bill or Notice (Notice Required) Sales and Use Tax File and Pay - E-500. Sales and Use Electronic Data Interchange (EDI)

What is NC form D-400 p1 2?

Form D-400 is the general income tax return for North Carolina residents. D-400 can be eFiled, or a paper copy can be filed via mail.

Can I download IRS tax forms?

Visit the Forms, Instructions & Publications page to download products or call 800-829-3676 to place your order.

Where can I find NC tax forms?

To download forms from this website, go to NC Individual Income Tax Forms. To order forms, call 1-877-252-3052. Touch tone callers may order forms 24 hours a day, seven days a week. You may also obtain forms from a service center or from our Order Forms page.

Can I download and print tax forms?

You can e-file directly to the IRS and download or print a copy of your tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 5coa to be eSigned by others?

To distribute your nc5 form, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How can I get file nc 5 online?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the nc department of revenue. Open it immediately and start altering it with sophisticated capabilities.

How do I fill out the ncdor nc5 form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign north carolina department of revenue and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is NC DoR NC-5X?

NC DoR NC-5X is a tax form used in North Carolina for reporting adjustments to income or tax credits that affect an individual's or business's tax liability.

Who is required to file NC DoR NC-5X?

Taxpayers who need to correct discrepancies or report adjustments to their previously filed tax returns are required to file NC DoR NC-5X.

How to fill out NC DoR NC-5X?

To fill out NC DoR NC-5X, taxpayers should gather their prior tax return documents, accurately complete each section of the form, ensuring all necessary adjustments and corrections are included, and then submit it to the North Carolina Department of Revenue.

What is the purpose of NC DoR NC-5X?

The purpose of NC DoR NC-5X is to allow taxpayers to amend their previously filed tax returns to correct errors, claim additional credits, or adjust their taxable income.

What information must be reported on NC DoR NC-5X?

The information that must be reported on NC DoR NC-5X includes details of the original return, the reason for filing the amendment, the specific adjustments being made, and any revised income or tax calculations.

Fill out your NC DoR NC-5X online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nc State Tax Form 2025 is not the form you're looking for?Search for another form here.

Keywords relevant to nc withholding form

Related to north carolina nc 5

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.