NC DoR NC-5X 2013-2024 free printable template

Show details

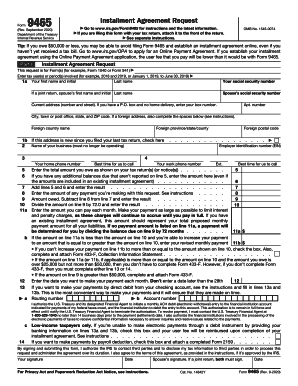

Instructions for Form NC5X, Amended Withholding Return Use Form NC5X to amend a previously filed Withholding Return, Form NC5. Indicate the period covered by the return to the blocks provided. Enter

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your schedule tax 2013-2024 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule tax 2013-2024 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit schedule tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit nc5x form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

NC DoR NC-5X Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out schedule tax 2013-2024 form

How to fill out form tax 1099:

01

Gather all necessary information, including the recipient's name, address, and Taxpayer Identification Number (TIN).

02

Identify the type of payment made to the recipient and select the appropriate box on the form.

03

Enter the amount paid to the recipient in the designated box.

04

Fill out the contact information section with your own name, address, and TIN.

05

Review the form for accuracy and completeness before submitting it to the IRS and the recipient.

Who needs form tax 1099:

01

Taxpayers who made certain types of payments throughout the tax year are required to fill out form tax 1099.

02

Businesses and self-employed individuals who paid contractors or freelancers $600 or more for services rendered during the year generally need to file form tax 1099.

03

Additionally, those who made mortgage interest payments, rent payments, or made payments to an attorney may be required to fill out form tax 1099.

Fill irs allowances : Try Risk Free

People Also Ask about schedule tax

What is form d400v?

What is NC form D-400 p1 2?

Can I download IRS tax forms?

Where can I find NC tax forms?

Can I download and print tax forms?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form tax 1099?

Form 1099 is a series of documents used to report various types of income received by an individual or business that is not typically reported on a W-2 form. There are several different types of Form 1099, including:

1. Form 1099-MISC: This is used to report income received by an individual or business for services performed, rent, or other miscellaneous income.

2. Form 1099-INT: This is used to report interest income received from banks, credit unions, or other financial institutions.

3. Form 1099-DIV: This is used to report dividends and other distributions received from stocks, mutual funds, or other investments.

4. Form 1099-R: This is used to report income received from pensions, annuities, or other retirement plans.

5. Form 1099-B: This is used to report proceeds from the sale of stocks, bonds, or other securities.

These forms are typically provided to the taxpayer by the payer of the income, but if they are not received, the taxpayer is still responsible for reporting the income on their tax return.

Who is required to file form tax 1099?

Form 1099 must be filed by any individual or business entity who has made certain types of payments during the tax year to non-employees (i.e., independent contractors, freelancers, etc.) and certain other entities. Some common examples include:

1. Businesses that have paid $600 or more to independent contractors or freelancers for services rendered.

2. Businesses that have paid $10 or more in royalties or broker payments in lieu of dividends or tax-exempt interest.

3. Financial institutions that have paid $10 or more in interest payments.

4. Businesses or individuals that have received $600 or more in rent payments.

5. Certain types of government entities.

6. Non-profit organizations.

7. Health and medical insurance providers.

8. Real estate transactions involving the purchase, acquisition, or abandonment of property.

9. Debt cancellation.

It's important to note that the requirements and thresholds may vary, so it is advisable to consult the official guidelines provided by the Internal Revenue Service (IRS) or seek professional tax advice to determine if you are required to file Form 1099.

How to fill out form tax 1099?

To fill out a Form 1099, follow these steps:

1. Obtain a blank copy of Form 1099 from the IRS website or from your tax software platform.

2. Gather your information: You will need the recipient's name, address, Tax Identification Number (TIN), and the amount paid.

3. Enter your information: Fill out your name, address, and TIN as the payer of the income.

4. Identify the recipient: Enter the recipient's information, including their name, address, and TIN.

5. Choose the correct box: Depending on the type of income being reported, choose the appropriate box on the form. For example, if reporting nonemployee compensation, use box 7.

6. Input the income: In the designated box, enter the total amount of income paid to the recipient during the tax year.

7. Complete any additional boxes or fields that may apply to your situation, such as state withholding or income earned through a partnership.

8. Double-check the information: Recheck all the entered information to ensure accuracy.

9. Make copies: Make copies of the completed Form 1099 for your own records, as well as for the recipient and applicable tax authorities.

10. Submit the form: Mail the copies to the recipient by the designated deadline, typically January 31st. Also, file the form with the IRS by the appropriate deadline, which is the last day of February if filing by mail or last day of March if filing electronically.

Remember, it is important to understand the specific requirements and deadlines for Form 1099 filing based on your circumstances. Consulting a tax professional or utilizing tax software can provide further guidance and ensure accurate filing.

What is the purpose of form tax 1099?

The purpose of Form 1099 is to report various types of income to the Internal Revenue Service (IRS). It is typically used by businesses and other entities to report payments made to individuals or organizations. Some common types of income reported on Form 1099 include non-employee compensation, interest, dividends, rent, and royalties. The purpose of this form is to help the IRS track and ensure that all taxable income is correctly reported by taxpayers.

What information must be reported on form tax 1099?

The specific information that must be reported on Form 1099 can vary depending on the type of income or payment being reported. However, some common information that is typically included on Form 1099 includes:

1. Payer's information: The name, address, and taxpayer identification number (TIN) of the person or business making the payment.

2. Recipient's information: The name, address, and TIN of the person or business receiving the payment.

3. Payment amount: The total amount of money or value of property that was paid during the tax year.

4. Type of income/payment: A description of the type of income or payment being reported, such as interest income (Form 1099-INT), dividends (Form 1099-DIV), or miscellaneous income (Form 1099-MISC).

5. Withholding information: If any federal income tax was withheld from the payment, the amount of tax withheld should be reported on Form 1099 as well.

It is important to note that there are various types of Form 1099 (1099-INT, 1099-DIV, 1099-MISC, etc.), and the specific information required can vary depending on the type of income being reported. It is recommended to consult the official instructions for the specific form to ensure accurate reporting.

When is the deadline to file form tax 1099 in 2023?

The deadline to file Form 1099 for tax year 2022 in 2023 is January 31, 2023.

What is the penalty for the late filing of form tax 1099?

The penalty for the late filing of Form 1099 can vary depending on the length of the delay and the size of the business. As of 2021, penalties for late filing of Form 1099 can range from $50 to $280 per form, with higher penalties for intentional disregard. These penalties can increase if the IRS determines that the failure to file was due to intentional disregard of the filing requirements. It is recommended to file Form 1099 on time to avoid any potential penalties.

How can I send schedule tax to be eSigned by others?

To distribute your nc5x form, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How can I get form 1099?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the nc 5x form. Open it immediately and start altering it with sophisticated capabilities.

How do I fill out the allowances withholding form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign nc 5x form and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Fill out your schedule tax 2013-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 1099 is not the form you're looking for?Search for another form here.

Keywords relevant to exemption withholding form

Related to form tax 1099

If you believe that this page should be taken down, please follow our DMCA take down process

here

.